Driving the innovation revolution of low-power AI processing for smart computing at the edge

03/27/2025- Blaize solutions optimized for low-power AI processing for smart computing at the edge

- Fueled by rising demand in existing beachhead sectors, as well as newly emerging use cases

- Expected acceleration of revenue driven by established and growing pipeline

EL DORADO HILLS, Calif.–(BUSINESS WIRE)–Blaize Holdings, Inc. (NASDAQ:BZAI) (“Blaize”), a provider of purpose-built, transformative artificial intelligence (AI)-enabled edge computing solutions that unite software and silicon to optimize AI from the edge to the core, has released its financial results for the fiscal year ending December 31, 2024.

Blaize CEO Dinakar Munagala said, “Having successfully concluded the Company’s business combination with BurTech Acquisition Corp. in January 2025, Blaize has seen continued interest in our AI-edge compute solutions from multiple parties in the Smart Cities, defense, and automotive industries. As we continue to focus on our go-to-market strategy and the overall market’s growing demand for AI at the edge, Blaize is well-positioned to expand our customer footprint.”

Fiscal Year 2024 Financial Highlights

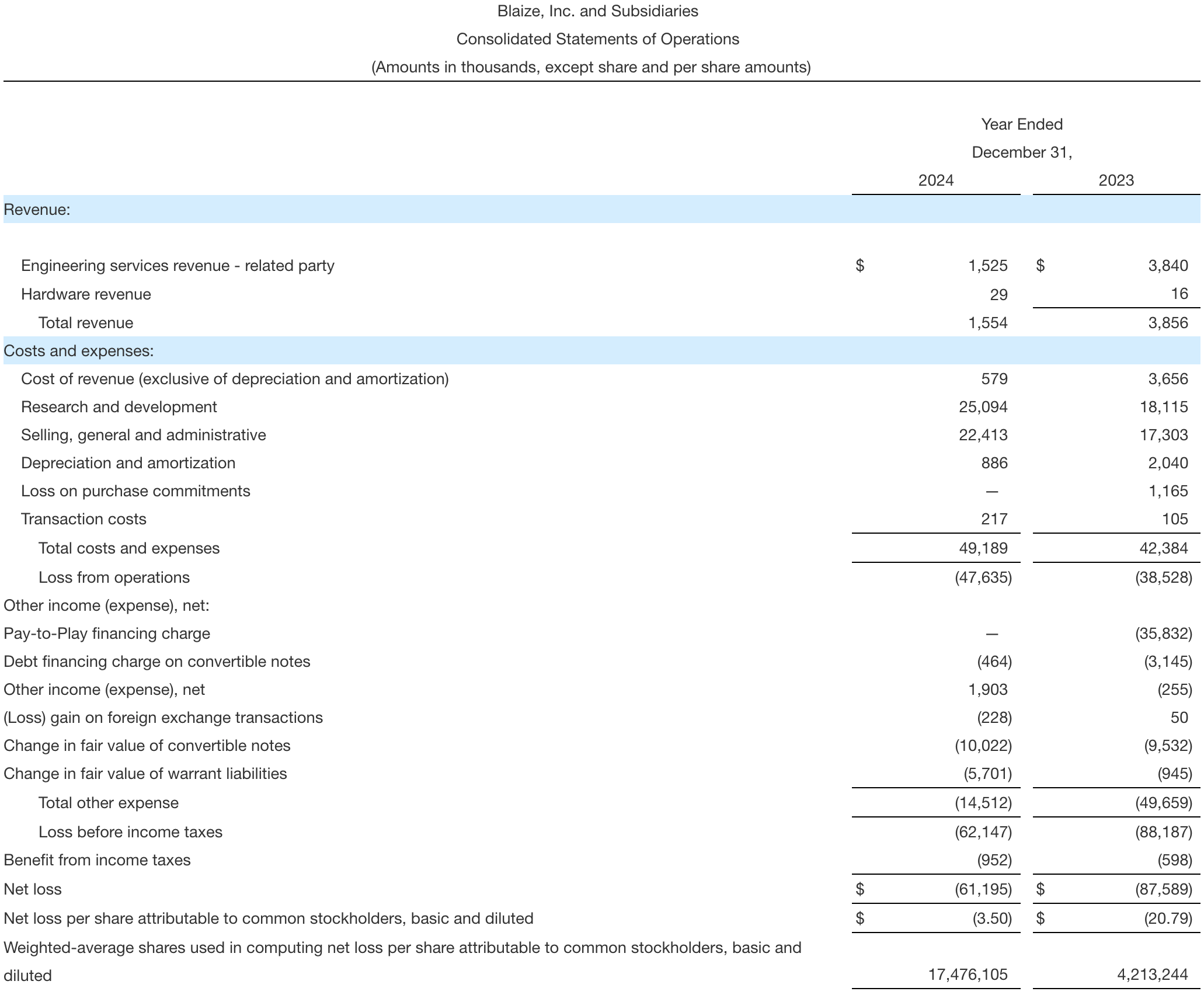

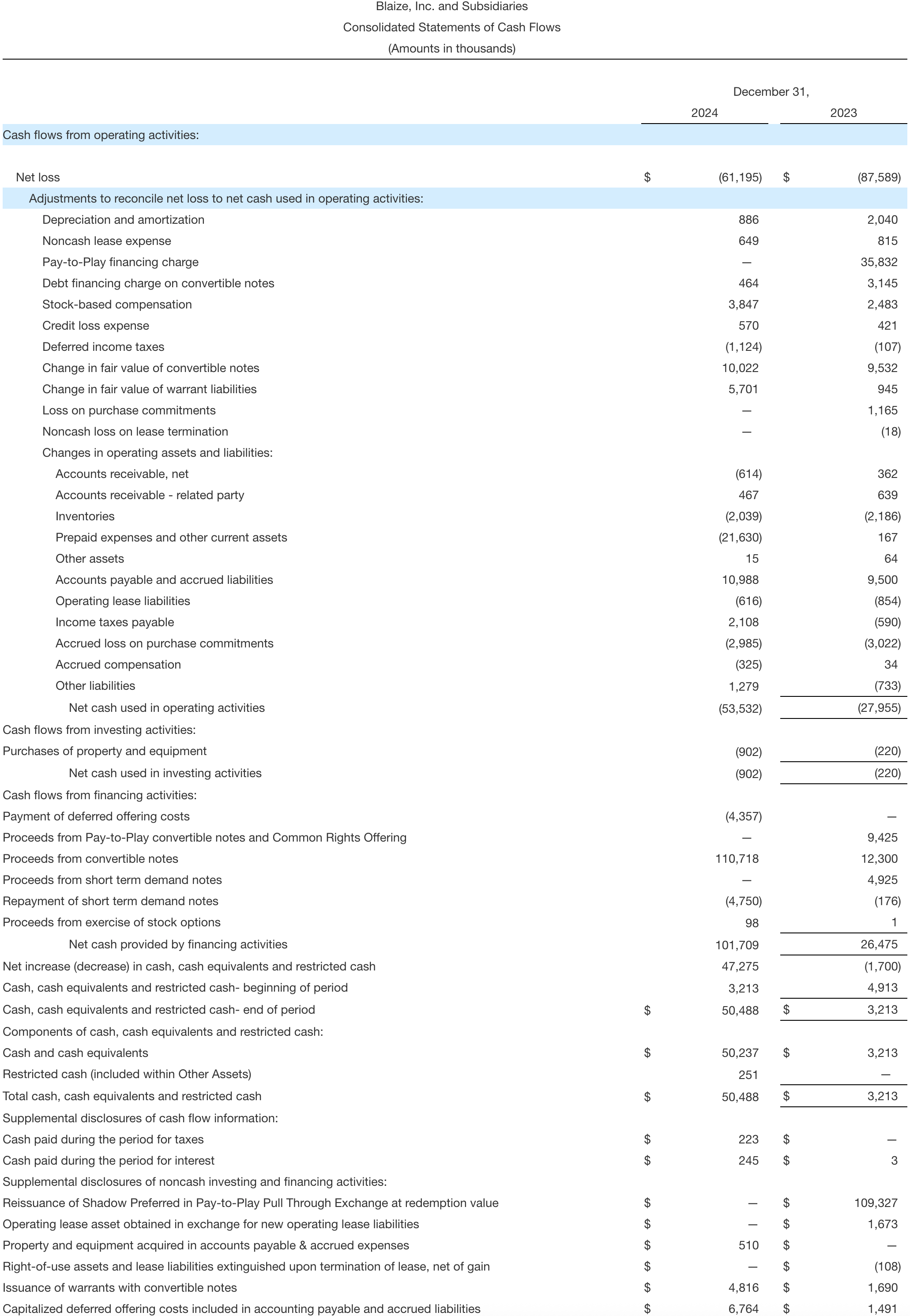

Results compare the year ended December 31, 2024, to the year ended December 31, 2023:

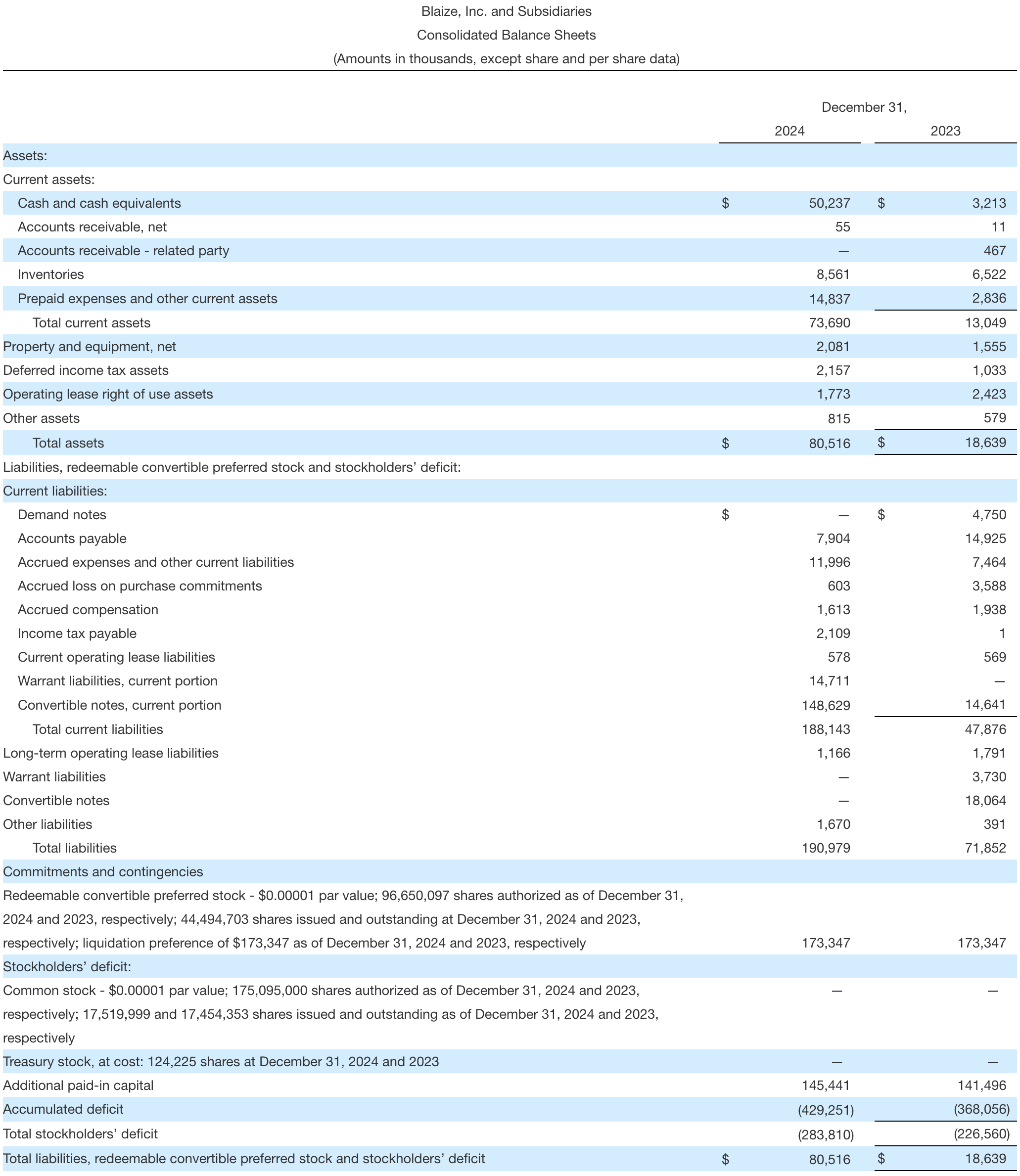

- Net revenue for fiscal year 2024 decreased to $1.6 million from $3.9 million in the prior year. In both years, the revenues primarily reflected the recognition of strategic consulting fees received from a major European automotive OEM as part of a multi-year and multi-vendor program. Phase I was largely completed during 2024 which accounts for the decrease.

- Net loss for fiscal year 2024 was $61.2 million, a 30% decrease from net loss of $87.6 million in the prior year. Included in 2024 were financing charges and fair value adjustments of $14.5 million related to convertible notes and warrant liabilities compared to $49.7 million for the prior year, which included a non-recurring Pay-to-Play equity financing charge.

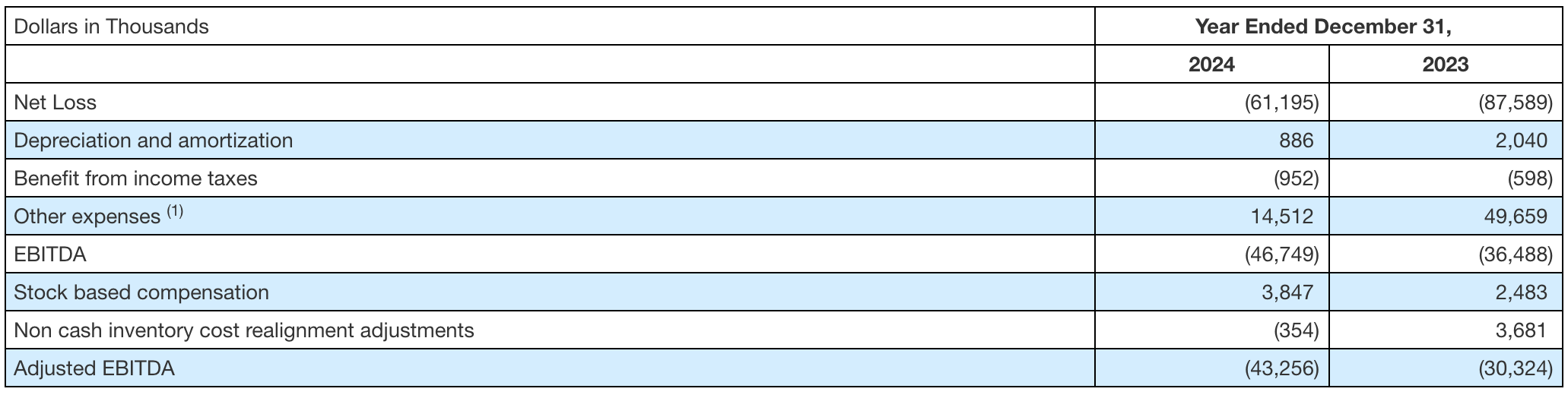

- Adjusted EBITDA loss, a non-GAAP measure of operating performance, reconciled to net loss below, for fiscal year 2024 was $43.3 million, compared to $30.3 million for fiscal year 2023. For a reconciliation of Adjusted EBITDA to net loss, the most directly comparable GAAP financial metric, see “Non-GAAP Financial Measures” below.

- As of December 31, 2024, Blaize’s cash and cash equivalents were $50.2 million.

Recent Business Announcements

Our pipeline continues to expand, driven by strong and accelerating market interest in AI at the edge, and ongoing engagement with high-quality prospective customers across key sectors, including, but not limited to, Smart Cities, defense, and the automotive industry.

- Joint technology agreement with KAIST to produce new edge AI computing applications across biomedical, neuromorphic, photovoltaics, thermoelectrics and green hydrogen

- Partnership with alwaysAI to revolutionize real-time insights with AI Edge Computing and advanced computer vision applications

- Partnership with VSBLTY to develop new AI-enabled hybrid technology for large-scale global safety and security solutions

- Partnership with Turbo Federal to procure contracts to accelerate AI solutions for the U.S. Department of Defense

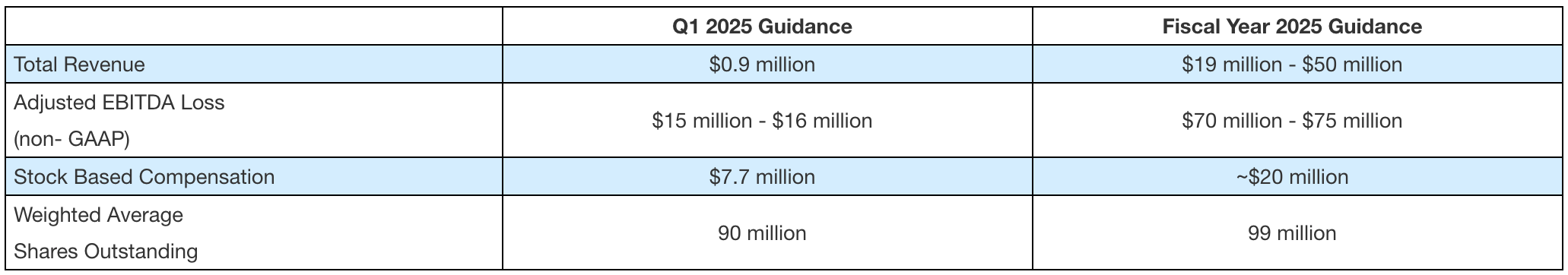

Financial Outlook

The following forward-looking statements are based on current expectations, and actual results may differ materially, as described below in “Cautionary Statement Regarding Forward-Looking Statements.”

Earnings Conference Call

Dinakar Munagala, Chief Executive Officer of Blaize, and Harminder Sehmi, Chief Financial Officer of Blaize, will host a conference call at 2:00 p.m. Pacific Time today, March 27, 2025, to discuss the Company’s financial results and outlook. A live webcast will be accessible on Blaize’s investor relations website at ir.blaize.com, and an archived conference call webcast will be available on Blaize’s investor relations website for one year following the live call.

About Blaize

Blaize provides a full-stack programmable processor architecture suite and low-code/no-code software platform that enables AI processing solutions for high-performance computing at the network’s edge and in the data center. Blaize solutions deliver real-time insights and decision-making capabilities at low power consumption, high efficiency, minimal size, and low cost. Blaize has raised over $330 million from strategic investors such as DENSO, Mercedes-Benz AG, Magna, and Samsung and financial investors such as Franklin Templeton, Temasek, GGV, Bess Ventures, BurTech LP LLC, Rizvi Traverse, and Ava Investors. Headquartered in El Dorado Hills (CA), Blaize has more than 200 employees worldwide with teams in San Jose (CA) and Cary (NC), and subsidiaries in Hyderabad (India), Leeds and Kings Langley (UK), and Abu Dhabi (UAE). To learn more, visit www.blaize.com or follow us on LinkedIn and on X at @blaizeinc.

Non-GAAP Financial Measures

In addition to providing results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”), we present Adjusted EBITDA, which is a non-GAAP financial measure. This measure is not considered a measure of financial performance or liquidity under GAAP and the items excluded therefrom are significant components in understanding and assessing our financial performance or liquidity. This measure should not be considered in isolation or as an alternative to GAAP measures such as net income (loss) or other financial statement data presented in our financial statements as an indicator of our financial performance or liquidity.

We define Adjusted EBITDA as EBITDA as further adjusted for certain items management believes are not reflective of the underlying operations of our business, including but not limited to (a) stock-based compensation; (b) non-recurring inventory cost realignments; and (c) other non-recurring charges. Net loss is the most directly comparable GAAP measure to Adjusted EBITDA.

We use Adjusted EBITDA to assess the operating results and effectiveness and efficiency of our business. We present this non-GAAP financial measure because we believe that investors consider it to be an important supplemental measure of performance, and we believe that this measure is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Non-GAAP financial measures as reported by us may not be comparable to similarly titled metrics reported by other companies and may not be calculated in the same manner. These measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP.

In reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, we have not reconciled the forward-looking Adjusted EBITDA (Non-GAAP) for the first quarter of 2025 or full fiscal year 2025 included above because we are unable to quantify certain amounts that would be required to be included in net income (loss), the most directly comparable GAAP measure, without unreasonable efforts due to the high variability and difficulty in predicting, with reasonable certainty, certain items excluded from Adjusted EBITDA. Consequently, we believe such reconciliation would imply a degree of precision that would be misleading to investors. Preparation of such reconciliations would require a forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to Blaize without unreasonable effort. For the same reasons, Blaize is unable to address the probable significance of the unavailable information. We expect the variability of these excluded items may have an unpredictable, and potentially significant, impact on our future GAAP financial results.

The following table sets forth a reconciliation of net loss to Adjusted EBITDA for the periods presented:

(1) Includes but not limited to interest receivable/payable, financing charges, gains/losses on foreign exchanges and movements in fair value of convertible notes and warrants.

Cautionary Statement Regarding Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are based on beliefs and assumptions and on information currently available to Blaize, including statements regarding the industry in which Blaize operates, market opportunities, and product offerings. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “target,” “seek” or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these words. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) the expected benefits of Blaize’s business combination with BurTech Acquisition Corp. (the “Business Combination”) are not obtained; (iii) the ability to continue to meet stock exchange listing standards following the consummation of the Business Combination; (iv) the risk that the Business Combination disrupts current plans and operations of Blaize as a result of the consummation of the Business Combination; (v) failure to realize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (vi) costs related to the Business Combination; (vii) changes in applicable law or regulations; (viii) the outcome of any legal proceedings that may be instituted against Blaize; (ix) the effects of competition on Blaize’s future business; (x) the ability of the combined company to issue equity or equity-linked securities or obtain debt financing; (xi) the enforceability of Blaize’s intellectual property rights, including its copyrights, patents, trademarks and trade secrets, and the potential infringement on the intellectual property rights of others; and (xii) those factors discussed under the heading “Risk Factors” in our Registration Statement on Form S-1/A filed with the Securities and Exchange Commission (SEC) on February 10, 2025 and other documents filed by Blaize from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Blaize assumes no obligation to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law, including the securities laws of the United States and the rules and regulations of the SEC. Blaize does not give any assurance that it will achieve its expectations.

The financial projections in this release are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Blaize’s control. While such projections are necessarily speculative, Blaize believes that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of financial information or projections in this press release should not be regarded as an indication that Blaize, or its representatives and advisors, considered or consider the information or projections to be a reliable prediction of future events. The independent registered public accounting firm of Blaize has not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this press release and, accordingly, has not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this press release.

Contacts

Investors

ir@blaize.com

Media

Leo Merle

info@blaize.com